14:00 ▪

4

min reading ▪ acc

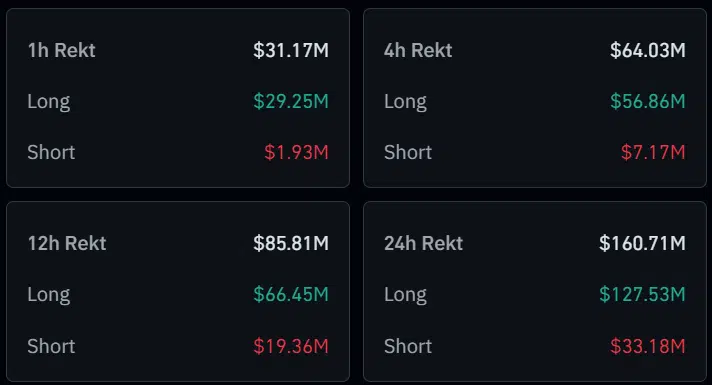

The situation is turning again in the crypto markets. Within hours, large liquidation movements swept through the ecosystem, totaling a hefty $160 million. A fresh reminder, if ever one were needed, of the unpredictability that continues to define this promising young sector.

Crypto: Massive Liquidation, Symptom of Unpredictable Market

The data speaks for itself: over 160 million dollars in open positions were cleared from the crypto market in 24 hours. Bitcoin alone has burned nearly $20 million. But it’s Ethereum that wins the liquidation prize with a whopping $27.8 million wiped. The shock is all the more serious as the ETH price recently hit new highs, boosted by the approval of spot ETFs in the United States.

However, apart from the monster, this wave did not spare any actor. Many smaller projects have suffered the full brunt of these chaotic movements. Like Notcoin, whose positions of almost $6.2 million were wiped off the map in record time. In short, the numbers speak for themselves: volatility remains a major challenge for the entire crypto ecosystem, regardless of capitalization.

Controversial role of major centralized platforms

If these recent convulsions in the stock market clearly illustrate the general immaturity of the market, we must also not obscure the central responsibility of the main cryptocurrency platforms. At the head of this shock quartet, Binance stands out as the epicenter of the latest wave of liquidations, with $75.8 million in positions lost in just 24 hours. An astronomical number that alone accounts for almost half of the purges that have hit all cryptocurrencies.

Beyond Binance, other heavyweights are equally affected by this speculative tidal wave. OKX leads with 53.9 million liquidations, followed by Bybit (14.2 million) and Huobi (11.3 million). Ultimately, these four major centralized exchanges concentrate most of the damage and crystallize the very overexposure to risk that plagues the crypto asset market.

The recent turbulence will no doubt be an uncompromising revelation of the still prevalent immaturity in the crypto market. However, rather than ringing a bell to the dying technologies in the making, these tumults call for the continued transformation of the sector towards greater maturity and stability. A titanic challenge, to be sure, but necessary to ensure the sustainability of digital assets as a true alternative to traditional financial systems.

Maximize your Cointribune experience with our “Read and Earn” program! Earn points for every article you read and get access to exclusive rewards. Register now and start reaping the benefits.

Click here to join “Read and Earn” and turn your cryptocurrency passion into rewards!

The world is evolving and adaptation is the best weapon to survive in this wavy universe. Essentially a crypto community manager, I am interested in anything directly or indirectly related to blockchain and its derivatives. To share my experiences and raise awareness of a field that fascinates me, there is nothing better than writing articles that are both informative and relaxing.

DISCLAIMER OF LIABILITY

The comments and opinions expressed in this article are solely those of the author and should not be considered investment advice. Before making any investment decision, do your own research.